4 November 2020

Introducing RoRos

VesselsValue launches RoRos as part of offering.

To accompany the launch, Dan Nash, Head of RoRo, wrote an article on how this new sector ties into a Brexit and Covid world. Success in shipping as we know, is all about timing, and this new climate may present buying opportunities for RoRos, considering they have an average lifespan of just over 30 years.

Read the full article below.

Brexit Chaos: to Roll-on or Roll-off?

The UK Government’s £77.6 million freight contract agreement with leading RoRo (Roll-on/Roll-off) Operators Stena Line, DFDS, Brittany Ferries and P&O last month was deemed as “necessary to safeguard the smooth and successful flow of freight” as per Grant Shapps, Secretary of State for Transport. Essentially, freight capacity has been bought by the UK Government for the first 6 months of 2021 for vessels to call regularly into Felixstowe, Harwich, Hull, Newhaven, Poole, Portsmouth, Teesport and Tilbury as a hedge against likely congestion at gateway Dover and a hard Brexit. However, with all of Europe likely to be grappling with suppressed demand from Covid-19 for the best part of 2021, combined with an impressive armada of newbuild deliveries confirmed to hit European waters over the next 24 months – was it really necessary – noting the UK is the number one demand market for straight ramp RoRo trade? What can the data tell us on forward looking supply-demand fundamentals for the RoRo sector?

Operator Preparations for Brexit

CLdN added 25% capacity from Rotterdam, into London and Humberside last month, plus an extra vessel from Zeebrugge to meet growing demand from the UK stockpiling for Brexit. This followed new triangular services between Iberia (Santander/Leixoes), the UK (Liverpool) and Ireland (Dublin) “…proving freight routes can flourish without any governmental aid…” as per CLdN.

P&O upgraded their freight-only vessel between Dublin and Liverpool substituting in the Stena Forecaster to meet growing demand. Stena Line continued their fleet enlargement and modernisation programme adding 30% freight capacity to the Stena Mersey and Stena Lagan via 36-meter extensions. All major Operators are reporting tighter supply-demand fundamentals for sailings on the English Channel. VesselsValue’s Recency of AIS data backs this up, reporting an improved layup count equating to 4% of the fleet based on 8 days or more.

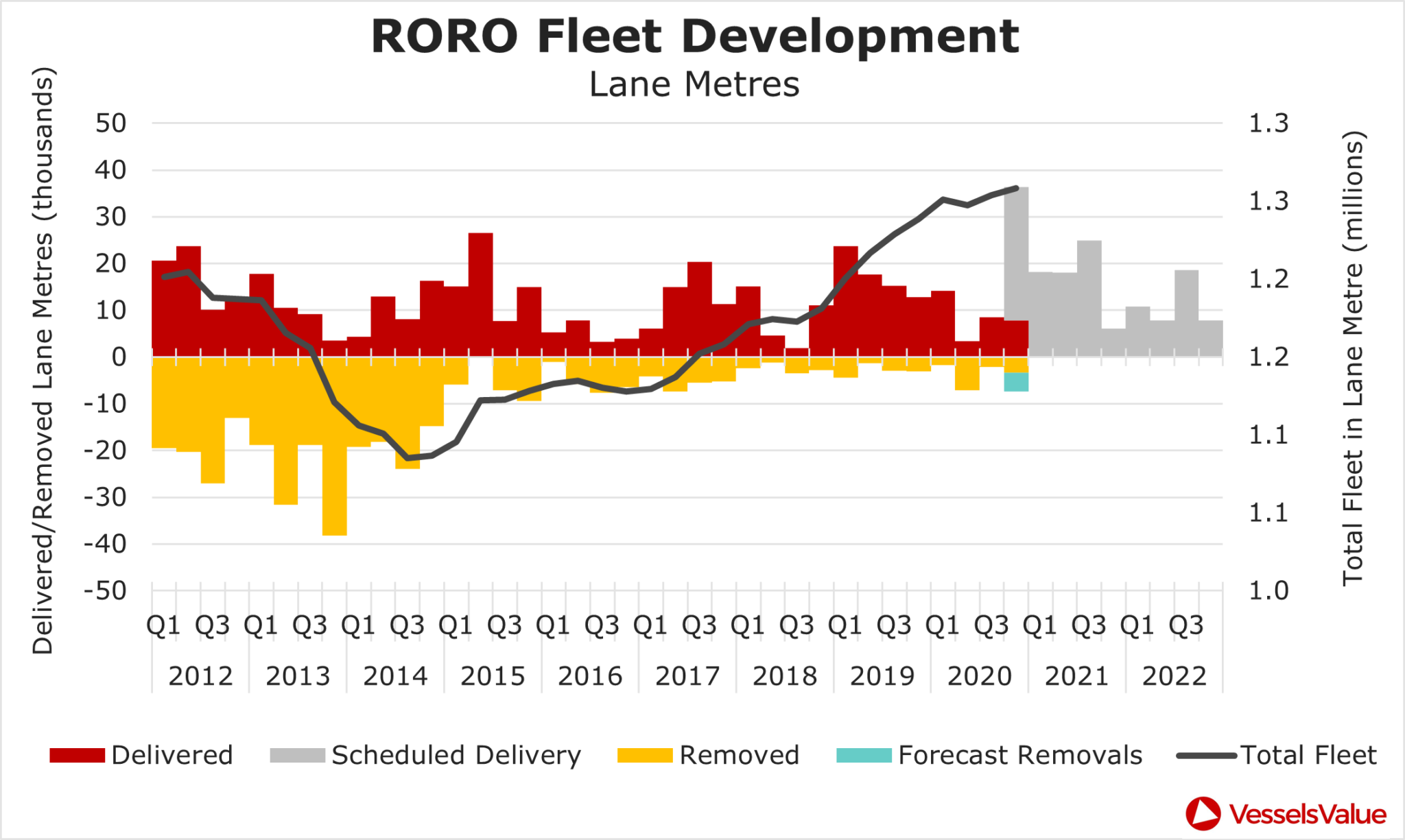

Fleet Development

Scheduled newbuild deliveries are set to add 112,000 LM to the fleet. However, we expect increased scrapping over the next two years as vintage, inefficient, obsolete tonnage is replaced by larger, economical, greener vessels. If we apply the peak removals average of 88,000 LM for 2012-14 as per Figure 1, we are still looking at a 2% increase to the total fleet for 2021 and 2022.

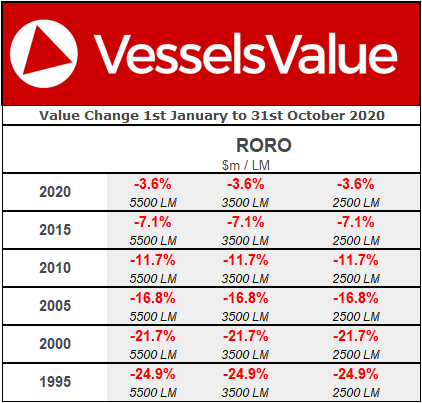

Asset Values

Values have fallen significantly since the 1st of January 2020 and are yet to recover following the demand collapse of Covid-19. Re-sales have held up pretty well losing 3%. Five year olds fell 7%. Ten year old vessels declined by 12%. Fifteen year old RoRos have fallen by 17%. Whilst twenty year olds have decreased by 22%. This may present buying opportunities for some considering the average life of a RoRo is just over 30 years. Success in shipping as we know, is all about timing.

Summary

Delays are inevitable as the UK switches over to the UK Global Tariff (UKGT) on the 1st of January 2021, adding administrative red tape, time and extra cost. Road, rail, terminal and berthing congestion are likely. The big unknown, to what extent and how long will it last? Is the UK Government expecting 6 months of chaos based on the duration of these Ferry contracts? RoRo services will not be able to run smoothly on the back of this deal. Investing in a modern, agile, international peer-to-peer customs software solution would have made more sense. Of course, it is never that simple.

One thing we can rely on is the data. At VesselsValue, clients use our data to get an unbiased objective opinion about future markets, to drown out the noise. Market insights are available through online access, reports, API feeds and exports, automated values, transactions, vessel information, mapping and tracking, and much more on a seamless platform that is quick and easy to use. VV enables you to make better investment and commercial decisions. We look forward to supporting the RoRo market having just launched into the sector with live values end of 2020!

By Dan Nash, Head of RoRo

About VesselsValue

VesselsValue Ltd. (VV) is a leading online valuation and market intelligence provider for the Maritime industry. VV went live in 2011 and has 2,500 users and works with over 600 global companies including major banks, leasing companies, shipowners, investment funds, hedge funds, lawyers, advisors and government regulators. The company has nine offices globally including London, Singapore, Shanghai, Hong Kong, and Oslo, with over 230 employees.

VesselsValue’s mission is to bring transparency and objectivity to the Maritime market through a wide range of services. Data and market insights are available through online access, reports, API feeds and exports, including automated values, transactions and fleet data, as well as AIS and ADS-B derived mapping & tracking, demand, utilisation and trade and people flows.

Visit https://www.vesselsvalue.com/ for more information.

Disclaimer: The purpose of this article is to provide general information and not to provide advice or guidance in relation to particular circumstances. Readers should not make decisions in reliance on any statement or opinion contained in this article.

See Press Disclaimer for use of VV data in the press.