Maritime

Value

We know how volatile and unpredictable the Maritime market can be. That’s why our values are updated daily, driven by algorithms and leverage the latest market transactions, negotiations and intelligence.

Values and data you can rely on

Available for the Shipping, Offshore, Passenger and Superyacht sectors.

Objective

Confidential

Updated daily

Vessel specific

Live and historical

Measurable accuracy

Follow the market in real-time with our values

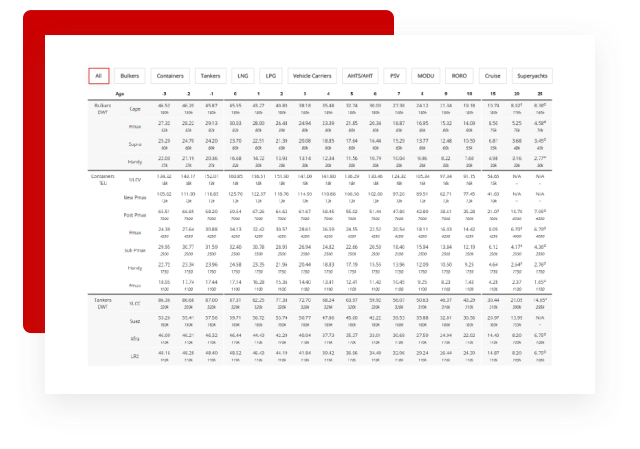

Access live, newbuild and historical values for individual vessels, company fleets and portfolios. View and compare across several valuation types.

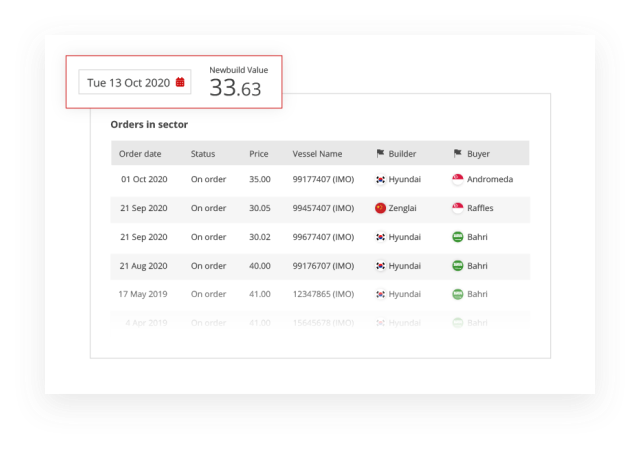

See what a vessel would be bought or sold for today, as well as historical trends going back as far as 1992. Easily compare with recent sales and charters in the sector including price, buyer, seller and charterer information.

See what a vessel would be bought or sold for today, as well as historical trends going back as far as 1992. Easily compare with recent sales and charters in the sector including price, buyer, seller and charterer information.

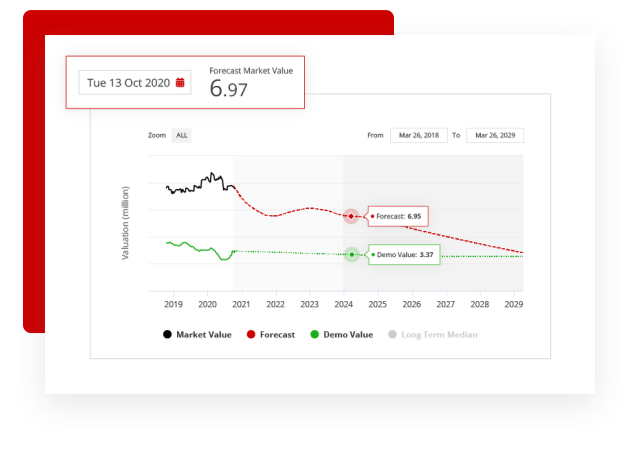

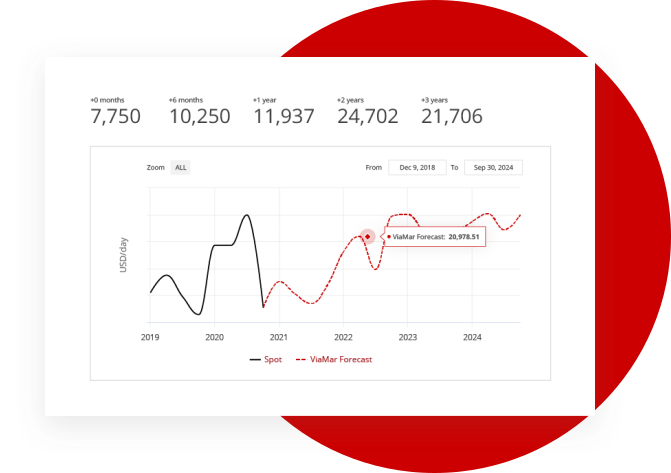

View Forecast Market Value predictions of a vessel until the end of its economic life including extensive market commentary. Forecast values are brought to you in partnership with Viamar AS.

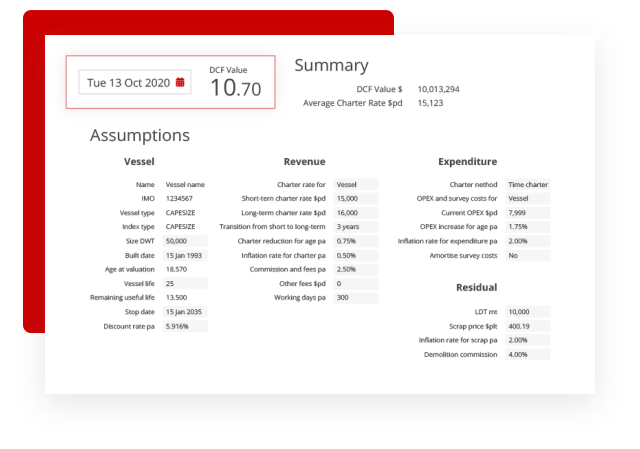

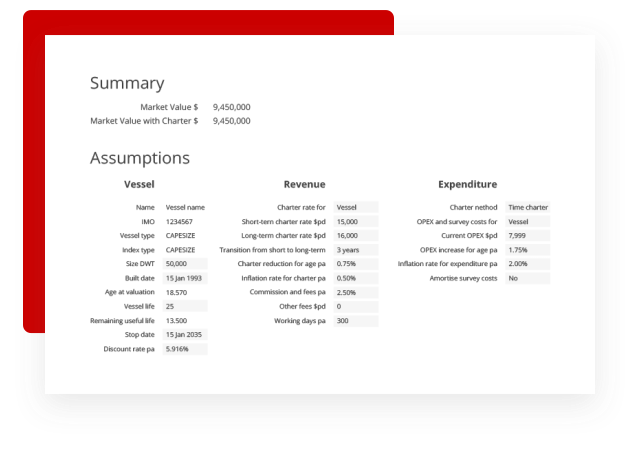

Model the long-term value of a vessel and projected cash flows, using our saved assumptions, or input your own.

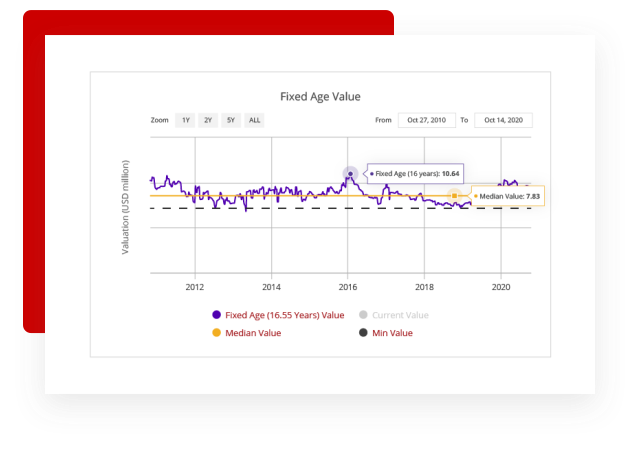

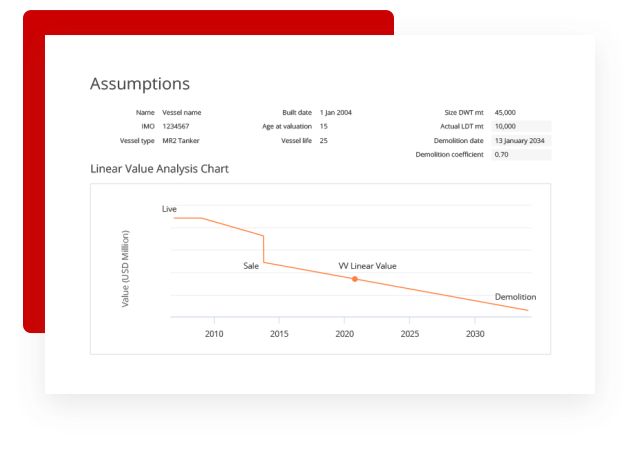

See the historical non depreciated value of a specific vessel, based on its current age.

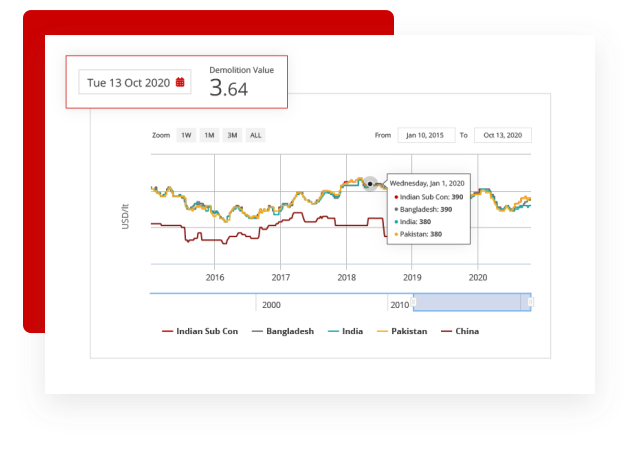

See what a vessel can be sold for in the multiple different ship recycling markets. Compare this with historical scrap prices and previous market transactions.

Identify what a newbuild vessel of equivalent specification could be contracted for today, between a buyer and a comparable shipyard.

See how the Market Value of a vessel is affected by a specific attached charter. Input your own charter information to model future earnings.

Estimate the likely book value of a vessel by taking the last purchase price and applying straight line depreciation to your desired valuation date.

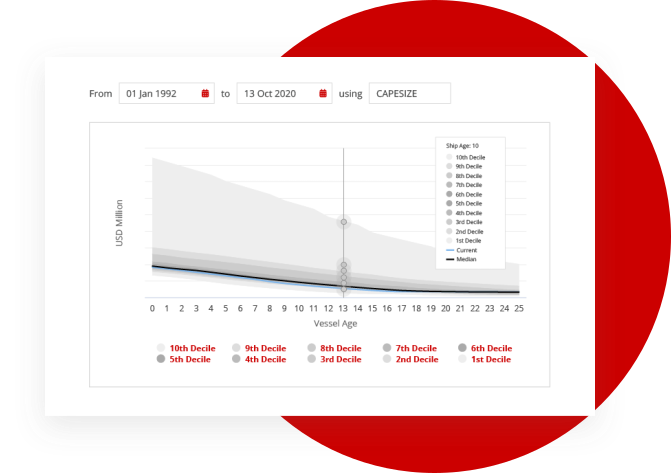

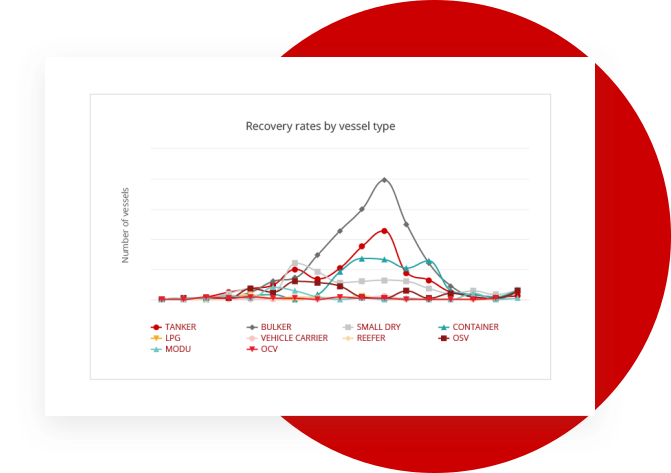

Assess historic market trends and future investment risks through analysis of the historical distribution of non-depreciated daily values as far back as 1992. Available as single vessel timeseries or aggregated probability distributions.

View four years of predicted charter rates of a vessel including extensive market commentary. Brought to you in partnership with Viamar AS.

See the current and historical discounts vessels received in a forced sales such as auction, bank or distressed sales.

View Market Values for generic vessels, by type and build year. Analyse percentage change over time.

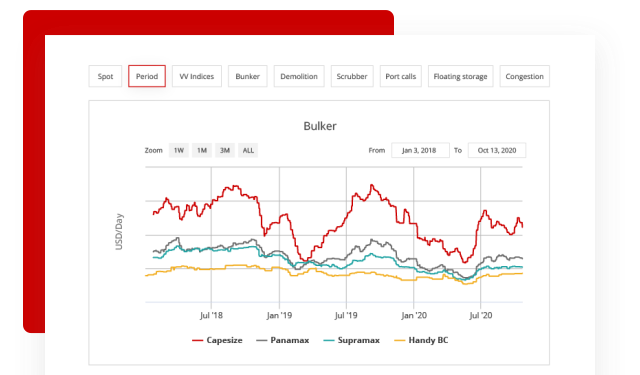

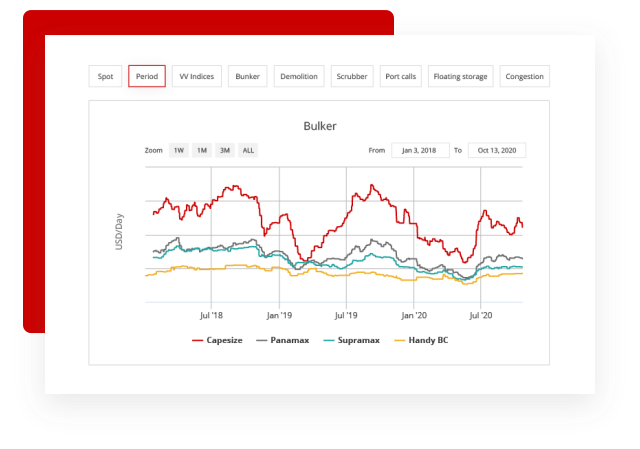

View comprehensive timeseries pricing data. Including current and historical datasets including spot and period charter rates, scrap prices, bunker prices, vessel scrubber fitting schedules, vessel port calls, congestion and delays, floating storage utilisation, rates of lay up, number of vessels in drydock and shipyard orderbook and many more timeseries.

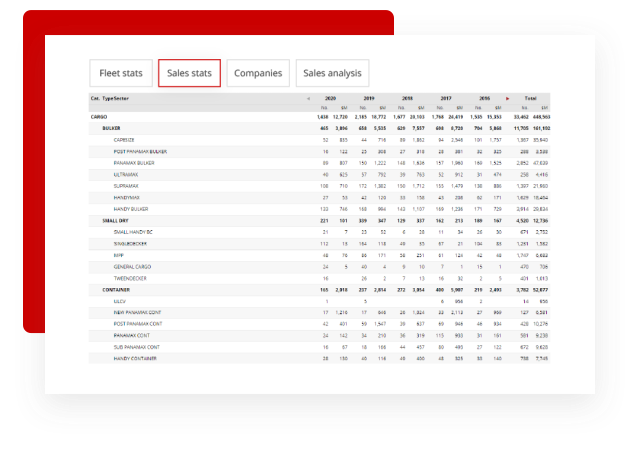

Get a summary of vessel statistics showing ownership, sales stats and fleet stats. View a breakdown of total value of annual sales and overall fleet by vessel type.

Official valuation certificates

- Download Market Value and Forecast Value certificates. Globally accepted by lenders, lawyers and auditors and used in fleet sales, public listings, M&A, expert witness evidence and governmental auctions.

Here are just some of the benefits

Address Risk

Quantify and understand financial and commercial risks.

Keep up with the market

Monitor fleet wide values in real-time or set up auto alerts.

Analyse trends

Understand current and historical market trends for individual vessels, fleets, companies or whole sectors.

Streamline reporting

Quickly and easily report values on vessels, fleet or portfolios.

Decide effectively

Support your decisions with objective data driven information.

Integrated data

Download data or setup APIs to input into your own models or systems.

Our methodology

Our Automated Valuation Model (AVM) methodology utilises advanced proprietary algorithms that have been continually developed and optimised from our origins in 2009 in the Maritime asset space. The AVM uses thousands of data points across asset specifications, transactions and market sentiment indicators, along with daily recalibration to ensure best possible fit to changing market conditions.

This model allows us to produce valuations even in highly illiquid markets.

For more information on our methodology please contact us at [email protected]

Want to know more?

Request a demo and start making informed decisions.